Rental properties- a beginner’s guide

When it comes to real estate, DC Fawcett says that the main objective of almost all realtors, investors is to put money to work today and see it grow in the future without much effort.

The ROI must be an adequate amount and it should be enough to cover:

- Risks that you take

- Taxes that you pay and

- The cost of owning the investment property together with additional expenses like utilities, regular maintenance, and insurance.

Abstractly, real estate investing really can be as simple as a walk in the park, if you are making some efforts to understand the most underlying factors of the investment, economics, and risk. With that said, you should know that it is simple but not easy. If you are lethargic, then based on the mistakes that you commit, the penalties may show a discrepancy from negligible hassles to major disasters. But at the same time, you should know that could noteworthy mistakes will make you bankrupt or worse.

Buying rental properties may not be everyone’s dream, but definitely, a whole lot of people out there like to invest on them. For it, you should know which type of real estate investment is suitable for you and which one you should be making. When you are done with the thought process and all set to initiate the progression of real estate investing, it is vital to settle on which type of real estate investment is appropriate for you.

In order to help you be aware of the available options, I’ll be sharing another article which will help you understand which type of real estate investment is suitable for you whether industrial properties, residential investments, etc. Alright, now gets into the beginner guide for rental properties.

Some tips on how to purchase your real estate investment properties:

There are quite a few ways that you can contemplate on, if this is your very first attempt, and then you can bring in some debt by taking a mortgage out against a property. In general, it is the use of leverage that creates a center of attraction for many real estate investors for the reason that it lets them get hold of properties they or else could not come up with the money for. On the other hand, employing leverage to purchase real estate can pose several threats in a market that is falling completely or otherwise where the interest expense and other timely payments can drive the real estate investor into bankruptcy if they aren’t cautious.

Virtual real estate investing club exists to help you figure out the hindrances in virtual real estate investing. You will get to know about the strategies and by this means, you can start real estate investing part time and start cashing checks for $5,000-$10,000 with Zero Money Invested and without using your credit. Educating real estate investors with his unique strategies, learn more about DC Fawcett real estate programs to unearth success in the field of real estate.

Suggestions when buying your first investment property

Many people who have invested in the real estate have turned affluent. So, real estate investment might seem a viable option. But, you need to contemplate much before you make any move. Purchasing the first investment property is not an easy task. When you carry it out smoothly, investment in property could produce a steady income.

Browse through a number of properties:

Some investors just make a speedy skimming through the property in the vicinity, and they dive head first into the deal. It is to be noted that these people are spending more than the actual value of the property.

You need to thoroughly go through many properties in the vicinity, and also in other areas before you choose a property. You need to come to terms with the worth of the property, and you need to make sure that it helps you attain your monetary ends. Skimming through hundred properties might seem like a lot. But, as the internet plays a major role, it is much easier to browse through a number of properties. There are a number of websites which enable easy search for properties. Do a fair study, and browse through a lot of properties before buying one.

Do not become emotional:

Being emotional plays a major role in the purchase of the property, and it could hinder the process of selecting the right property. You will end up paying more than the actual value of the property. Usually, sane decisions are not taken when the emotion overtakes. The fact being that it is your residence, there will certainly be a role played by the emotions. But, take the investment as a financial transaction, and consider it like purchasing stocks.

Make way for investment goals:

You have to set a financial target before you go for acquiring a property. Some people cannot actualize on what property would yield them fruitful results.

It is not a sane decision to choose a property which has not been maintained well. This is particularly the case when it comes to earning a passive income. Ending up buying a property in the rural area is not the desirable out come if you want speedy capital growth.

Setting a financial goal helps you self-actualize and understand what your needs are. You can buy properties that adhere to the goal.

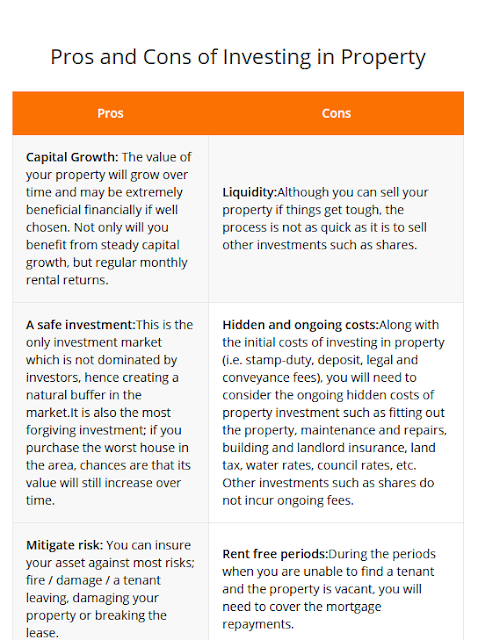

Putting investment into property is a sound decision when you want to acquire profitable returns.

Do not hasten:

When purchasing the first investment property, some people tend to be impulsive and they get excited. Also, they desire to purchase property as soon as they can. But, understand that the market is there always, and properties for sales are always accessible. Do not go out and pay an exorbitant sum on a property which is not going to get you the profits. Take sufficient time for the research of the property when you are purchasing property in vicinity that you do not know.

Make a thorough research in the area:

You might be residing in the area for quite a long time. But, that does not imply that you have a full understanding regarding the property. And, you have to understand what the property is going to yield in your desired area.

Make a comparison with other properties in the area and understand what the rental returns are. Go for a property that is desired by everyone in the area

Conclusion:

DC Fawcett is a real estate entrepreneur come trainer, helping all real estate fervents to achieve their goals by means of his seminar and camps. In addition, he also teaches how to develop a real estate business and produce different income streams.

0 comments:

Post a Comment